Introduction

Catholic Charities (CC) first came on my radar growing up. They were in the community, I thought little of it. Fast forward many decades, the next time I can remember even thinking about this group was when they started greeting illegal migrants in DC that had been bused there by TX Governor Abbot.

The article is here.

“They (Catholic Charities) provide food, an opportunity to shower, and gift cards for migrants to spend at their discretion. They also bought toys for a family with young children, and have helped migrants with bus tickets to continue their journey. It’s split fairly evenly between migrants who are met by family or friends and stay in Washington, D.C., and those who have plans to travel elsewhere in the country….”

There was so much to unpack in this paragraph. What? Wait? A 501(c)(3) is giving away resources to illegal immigrants? Do the private donors of Catholic Charities know this? I could ask a lot of questions here.

CC also caught my attention this year when they were driving around car loads of illegal immigrant children and the residents of this TX town recorded it on video. The towns folks were not too happy with CC for that.

There is also a consistent pattern of trafficking illegal migrants (aka future D voters) that you can follow here.

More recently, CC has popped up in various forums that I read related to speculation about ballot harvesting operations. Again, I have no direct proof that is happening but it peaked my interest enough to pull back the curtain on the IRS 990’s for this group.

What I found shocked me, maybe it should not have, but it did.

Analysis

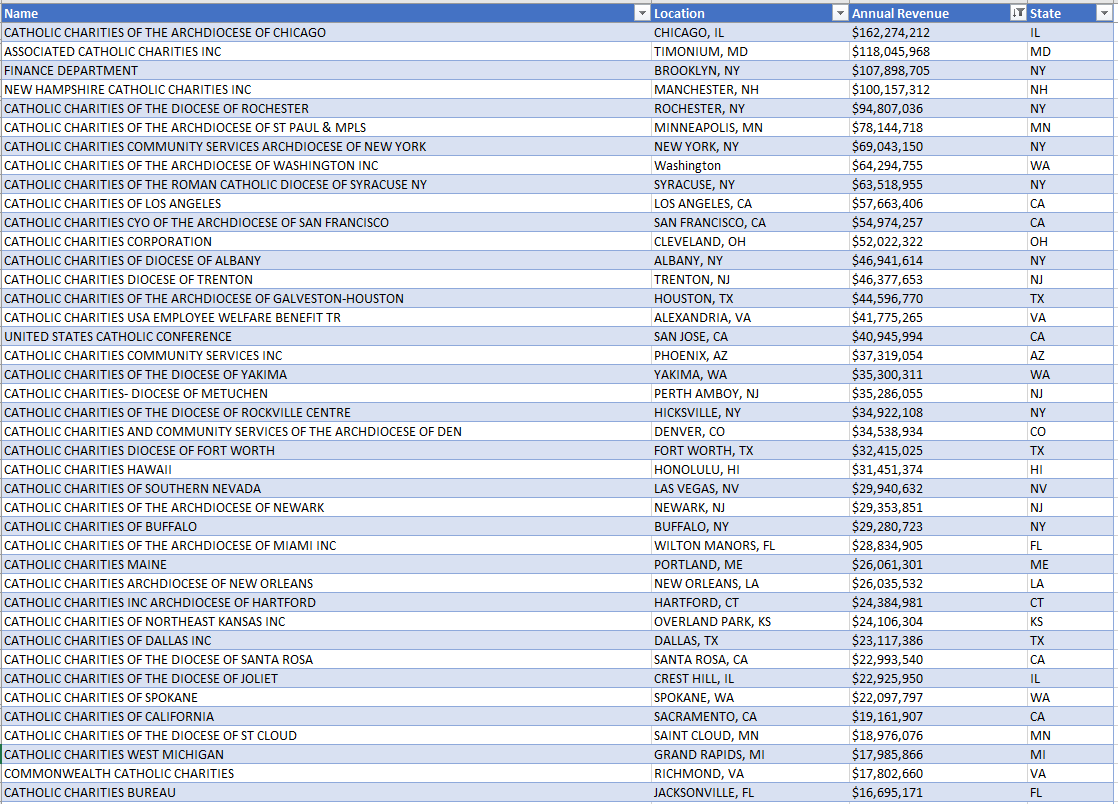

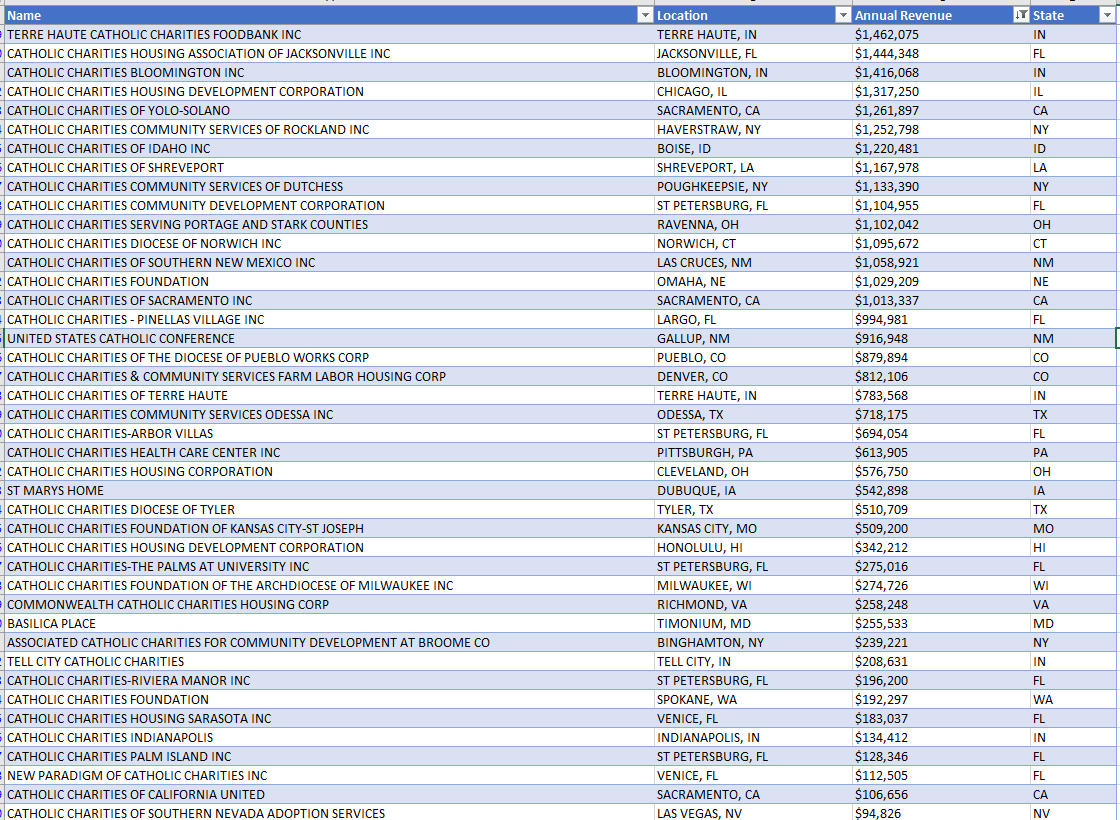

Using ProPublica as a source, I scraped the basic revenue data from the web for all CC organizations in the US for 2019.

The total annual revenue for all 168 organizations is $2.5 Billion with a “B”. CC is in 41 of the States and if you do the math (168/41) has on average ~ 4 organization in each of those states.

Here is the list of all the CC organization in the US sorted by 2019 annual revenue in descending order. The source is ProPublica.

Those parishioners sure are generous every year putting billions into the collection plate!

Except they are not……if you look at the 990. I did not look at EVERY organization, just a few of the top one’s. The trend is clear to me.

The majority of the annual revenue comes from YOU meaning the tax payer not the parishioner. There is also that mysterious category of “Other” revenue sources that does not require disclosure. And the expenses you ask? We will look at that too.

I don’t have the time or a staff to write an expose on all of these but will just focus on the top CC organization as an example: CATHOLIC CHARITIES OF THE ARCHDIOCESE OF CHICAGO.

Yep, Chicago, here we go again. My series of articles on another Chicago based organization CTCL is here. Also, of course home to one of our ex-Presidents. That is all a coincidence however.

Case Study

Here is the basic 2019 revenue and expenses summary for CATHOLIC CHARITIES OF THE ARCHDIOCESE OF CHICAGO.

Revenue

Contributions and grants: 153MM

1.8MM fundraising

117.5MM government grants

34MM in undisclosed grants

3.5MM non cash contributions

Service revenue: 10MM

Investments: 3.3MM

Other revenue: 2.5MM

TOTAL revenue: 169MM

Expenses

Grants: 13MM

Salaries: 87MM

Other expenses: 56MM

TOTAL expenses: 155MM

Revenue Less Expenses

14MM

Total Assets

181MM

Net Assets

35MM

Analysis

The main point is that 78% of the revenue are coming from YOU the tax payer.

If I use 78% to project how much of the overall annual revenue of CC in the US is coming from the tax payer that would amount to 1.95 Billion dollars a year.

Did you know that?

51% of the annual revenue in Chicago is spent on CC Salaries (87/169 ~ 51%)

Using that same analogy if we project 51% nationally, the tax payer is funding 1.5 Billion a year in salaries for CC nation-wide (2.95Billion x 51%).

Did you know that?

OK, maybe my national projections based on looking at Chicago alone are not EXACTLY correct, but that is not the point.

The scale of the tax payer funding here is enormous and much of the other revenue and “other” expenses are not fully transparent even though the returns comply with the tax code.

There is also an extensive network of senior housing affiliation grants. Here is a sample. Senior housing is a sensitive topic for reasons that are obvious to anyone following the election integrity movement, especially in WI.

Conclusion

I am sure CC does a lot of great work in the communities they serve, but that is not the point of this article.

As the movie 2000 Mules has shown, non-profits which advertise with the best of intentions often behave differently. I have no direct proof CC is involved with ballot harvesting.

Let’s keep an eye on this one in the coming weeks.

There sure is a lot of money floating around……..your money.